In the common perception of the phrase, momentum is an investment eyesight that favors shares that have been trending upward above the previous 6 and twelve months. At MarketScreener, Raytheon Systems, Air Products and solutions & Substances, Broadcom, Unitedhealth Group and Black Stone Minerals. A portfolio weighted on these 5 positions would have created a return of +17.05{5c5ba01e4f28b4dd64874166358f62106ea5bcda869a94e59d702fa1c9707720} in comparison to +3.24{5c5ba01e4f28b4dd64874166358f62106ea5bcda869a94e59d702fa1c9707720} for our benchmark, the S&P 500 Index, above the fourth quarter of 2022 (from 9/29/2022 to 12/31/2022). At the personal degree, Raytheon Technologies attained +22.08{5c5ba01e4f28b4dd64874166358f62106ea5bcda869a94e59d702fa1c9707720} for the quarter, Air Solutions & Chemicals +32.41{5c5ba01e4f28b4dd64874166358f62106ea5bcda869a94e59d702fa1c9707720}, Broadcom +21.31{5c5ba01e4f28b4dd64874166358f62106ea5bcda869a94e59d702fa1c9707720}, Black Stone Minerals +6.44{5c5ba01e4f28b4dd64874166358f62106ea5bcda869a94e59d702fa1c9707720} and Unitedhealth Team +2.99{5c5ba01e4f28b4dd64874166358f62106ea5bcda869a94e59d702fa1c9707720}. This variety significantly outperformed the U.S. Broad Index even though providing lessen volatility.

The Momentum Picks variety begun on January 1, 2022 ended the 12 months with a substantially far better functionality than the S&P 500: +2.67{5c5ba01e4f28b4dd64874166358f62106ea5bcda869a94e59d702fa1c9707720} versus -19.44{5c5ba01e4f28b4dd64874166358f62106ea5bcda869a94e59d702fa1c9707720} for the US index. This outperformance was predominantly obtained in Q2 and Q4 2022.

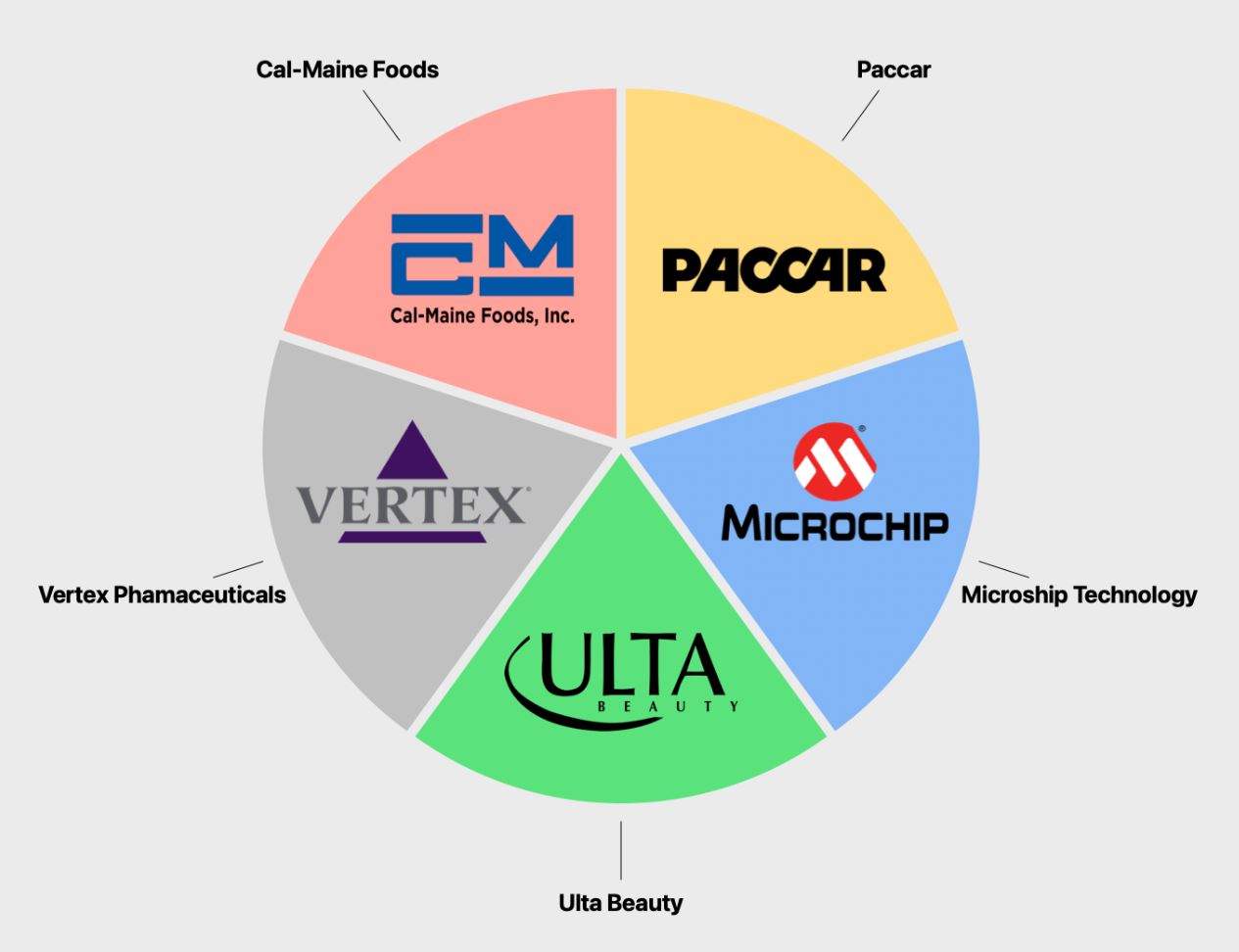

Let us just take a closer appear at the 5 U.S. shares selected for the to start with quarter of 2023:

Paccar

Paccar is a quite nicely-run corporation, arguably the best manufacturer of large-obligation cars. The organization offers a ROIC of virtually 12{5c5ba01e4f28b4dd64874166358f62106ea5bcda869a94e59d702fa1c9707720} to its shareholders. In excess of the earlier 20 years, product sales have grown at a constant price of 8{5c5ba01e4f28b4dd64874166358f62106ea5bcda869a94e59d702fa1c9707720} for each yr, with lower volatility even throughout recessions. EPS and gross sales revisions are bullish and momentum is good.

Supply: Paccar

Microchip Technologies

Microchip Technologies is a U.S. producer of semiconductors for the home merchandise, automotive, computer and telecom industries. Its flagship items are microcontrollers, which account for much more than 50{5c5ba01e4f28b4dd64874166358f62106ea5bcda869a94e59d702fa1c9707720} of its revenues, and programmable logic arrays (FPGAs for those people in the know). Microcontrollers allow automation and are getting to be extra and much more indispensable in a quantity of devices, notably in the automotive and linked item industries. The corporation need to continue on to expand this calendar year with a robust demand from customers from its customers. The group’s profitability is exemplary (net margin believed at 27{5c5ba01e4f28b4dd64874166358f62106ea5bcda869a94e59d702fa1c9707720} in 2023 and ROE of 50{5c5ba01e4f28b4dd64874166358f62106ea5bcda869a94e59d702fa1c9707720}). The valuation looks to be really affordable when compared to the good quality of the business and its long term prospective customers

.

Source: Microchip Technologies

Ulta Splendor

The undisputed chief in the sale of beauty items in the United States, Ulta, as it is recognised, has been ready to thwart the growth ideas of Sephora, the rival cosmetics retailer of the potent LVMH group, for a number of years. With a broad network of 1,300 stores, Ulta Elegance has founded alone about the previous 30 several years as the primary vacation spot for buyers for cosmetics, fragrances, pores and skin treatment, hair care and attractiveness expert services. Buyers have a large variety of items to pick out from. In Ulta’s shelves, you can discover an assortment of much more than 25,000 goods from in excess of 600 models. Ulta Attractiveness also distributes its own brand name, bought underneath the identical identify, which nowadays represents practically 6{5c5ba01e4f28b4dd64874166358f62106ea5bcda869a94e59d702fa1c9707720} of profits in conditions of income. The team is going through important advancement and its territorial implementation strategy is exemplary. Extra than 350 outlets below its own identify have been opened around the previous 5 a long time and a strategic partnership with the American retailer Concentrate on has enabled the opening of close to 100 shop-in-retailers. This enlargement, compared with some of its friends, has not been at the expense of profitability. Normal share buybacks and the defensive but development-oriented mother nature of the firm assistance the inventory.

Resource: Ulta Elegance

Vertex Pharmaceuticals

Vertex Prescription drugs is an American pharmaceutical firm specializing in the study and progress of drugs for the treatment of most cancers, viral, inflammatory and autoimmune disorders. Several treatment plans are in enhancement and the pipeline is full. These include things like the promising VX-522 in co-site with Moderna to deal with cystic fibrosis individuals and Exa-cel in collaboration with CRISPR Therapeutics to treat sickle cell sickness and beta thalassemia, which is in late Stage 3 and is predicted to be finished in Q1 2023. Vertex Prescribed drugs has capitalized on its cystic fibrosis treatments to invest in new superior-opportunity treatments, like cystic fibrosis. Revenues ought to continue on to develop in the coming many years and 2023 will surely be a excellent 12 months for Vertex. Further than the opportunity, the company’s remarkable profitability and balanced monetary placement make it a defensive growth inventory to be favored in periods of recession

.

Source: Vertex Pharmaceuticals

Cal-Maine Foods

What is more monotonous than an egg firm? Cal-Maine Foodstuff is the greatest U.S. egg producer in the United States. Its functions consist of hatching chicks, elevating and sustaining flocks of pullets, levels and breeders, producing feed, and developing, processing, packing and distributing shell eggs. Dull. But hey, what we’re intrigued in is what’s driving the appearances. The business is getting benefit of the HPAI epidemic that has caused egg costs to spike by much more than 30{5c5ba01e4f28b4dd64874166358f62106ea5bcda869a94e59d702fa1c9707720} in 2022 in the US. The company materials most US merchants, such as Walmart, who routinely obtain new eggs (this makes sure frequent earnings). The last handful of quarters have been extraordinary as this cost raise has boosted the Ridgeland firm’s internet margins to 24.8{5c5ba01e4f28b4dd64874166358f62106ea5bcda869a94e59d702fa1c9707720} in Q3 2022. Every person looks to agree that this would not last without end. I’m quite significantly in favor of this idea, but it may not be for a while nevertheless. 2023 should really be a further great year, specially the very first 50 percent of the yr. The enterprise need to proceed to benefit from large egg price ranges. Momentum is great and earnings revisions continue to be bullish.

.

Supply: Cal-Maine Foodstuff

You detect that this Momentum Picks portfolio is very well well balanced across 5 sectors (consumer staples with Cal-Maine, health care with Vertex, customer discretionary with Ulta, technology with Microchip and industrials with Paccar). We shall satisfy again at the stop of March 2023 to evaluation its progress and suggest a choice for the following quarter.